City Index

City Index is a derivative brokerage firm that offers customers a platform for spread betting and trading forex and Contracts for Difference (CFDs). CFDs allow traders to speculate on asset prices without owning them. City Index is a Financial Conduct Authority (FCA) regulated broker with global operations, most notably in the UK, Australia, Singapore, and the United Arab Emirates.

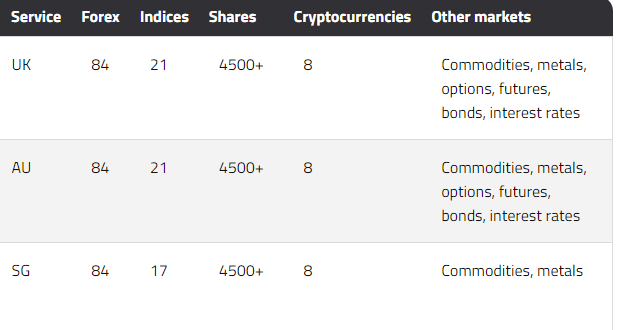

City Index is a well-regulated broker that offers its customers access to over 12,000 markets across forex, indices, shares, commodities and – in limited countries – cryptocurrencies. Customers can take comfort in the broker’s 38-year operating history and strong financial backing from its publicly traded parent company.

City Index offers a wide variety of trading platforms, including robust mobile applications on iOS and Android for on-the-go traders.

This City Index review covers facts about the broker, explores major advantages and disadvantages, and whether City Index is available for traders in India.

City Index offers some of the best trading tools and analysis to help traders perform better. Their unique post-trade analytics and voice brokerage service make it an excellent choice for large and frequent traders.

Pros

Excellent trading tools

Post-trade analytics

Publically listed (part of StoneX)

Cons

Trading only, no investment account

Limited options markets

No direct market access

Account Types and Requirements

City Index offers a standard trading account, a professional account (invitation only), and two types of demo accounts.

There is no minimum deposit to open a real trading account, although City Index recommends $/£/€100 to get started.

Traders can use demo accounts for up to twelve weeks, and City Index provides them free of charge. The City Index demo account comes with 10,000 demo credits and allows access to all features of the platform.

The MT4 demo account also comes with 10,000 demo credits, along with access to the forex market.

Account Requirements

After you click the green “Create Account” button the website, City Index, asks you a few questions related to:

1. Your personal details

2. Which products you want to trade in your account (spread betting, CFDs or both)

3. Your financial status

4. Your trading experience

When opening an account, traders can choose whether they want a CFD account, a spread betting account, or a single account with both products.

City Index doesn’t have specific criteria to qualify new traders but aims to ensure some competence and understanding due to the risks involved.

Trading Platform

The City Index platform used to have a slightly off-the-rack feel about it, instead, the business relied on word of mouth and friendly referrals from HNW clients who would use experienced dealers to work large orders over the phone. Whilst voice brokerage still forms part of City Index’s offering, they are, as with everyone else, doing the majority of their business online and working hard to make their platform stand out.

City Index Trading Products

This section gives you an overall impression of City Index’s trading products. City Index offers trading on CFDs for indices, shares, forex, cryptocurrencies (not in US/Canada), and other markets.

Customer Support

The City Index team are available 24 hours-a-day, 5 days-a-week via:

Live chat

Phone

support Email

More, City Index offers various support materials, not including their main library of educational resources. Traders can access tutorials on getting started via the web trader.

Awards

In our latest awards City Index won “best trader tools” 2023 and has in previous years won best trading platform, best trading app & best forex broker in 2022.

Is City Index a Worthwhile Platform?

All in all, City Index offers multiple cross-platform trading applications, 24/5 customer support, and a variety of asset classes and products to choose from.

The broker covers many major and minor markets globally, with over 12,000 products.

A 12-week demo account with 10,000 credits is available for both retail and professional traders to explore and make a clear decision on whether City Index is a worthwhile broker.

0 Comments