IC Markets Review 2024 – Trade with True ECN Forex Broker

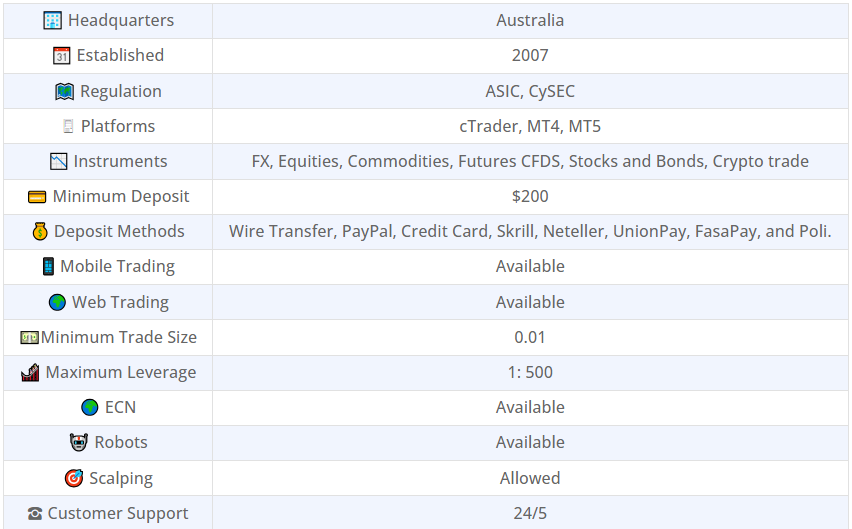

IC Markets is a popular and world-renowned broker in the currency and CFDs markets founded by Andrew Budzinski, a reputed entrepreneur in 2007. Our IC Market review research reveals that the firm offers traders competitive spreads and a wide range of tradable items across multiple asset classes.

IC Markets is based in Sydney, Australia, with company headquarters at 6 309 Kent Street Sydney, NSW 2000. Our research for this IC Markets review reveals that, compared with the most prominent brokers, this particular broker stands out as one of the best forex broker a trader can choose.

To get started, traders will need to fund their IC Markets’ minimum deposit, set at $200.

As far as our research goes, traders should not worry about safety concerns because IC Markets is appropriately regulated. The broker is currently registered under three major regulatory bodies. They include the Seychelles Financial Supervisory Authority (FSA) and the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Exchange Commission (ASIC).

The IC Markets live account opening process is easy and fully digital, allowing you to trade as soon as possible.

Because of the safety precautions and a good reputation in the currency and CFDs market, IC Markets is perfectly safe for both beginners and advanced traders.

IC Markets review details show that the firm promotes itself as the most suitable broker for traders who move high volumes, use algorithms or scalp. Their fast execution speeds are courtesy of their New York Equinix Data Center. Using this resource, they can process up to half a million trades a day.

In addition to the fast execution speed, traders who want to learn more about the market can integrate with ZuluTrade and MyFXbook.

IC Markets Review 2024 Quick Summary

What We Like About IC Markets

They have institutional-level liquidity available to those on the raw spread accounts.

If you want to trade commission-free, IC Markets has accounts that charge no commission.

Their platforms are not limited to MetaTrader as they include cTrader for mobile, web, and desktop.

They have available customer support 24/7

Their range of products is adequate.

They provide an extensive library of educational and research resources.

What IC Markets Could Improve

New traders may find it hard to pick products to trade because of the wide range. If IC Markets could guide beginners on how to select products, it would be a welcome addition.

IC Markets Regulation

IC Markets operates across multiple jurisdictions. Because of that, they can only be considered safe if they are well-regulated in all jurisdictions. Our IC Markets review research shows that IC Markets is registered with the following regulatory agencies:

The Australian Securities and Investments Commission (ASIC)

The Cyprus Securities and Exchange Commission (CySEC)

The Seychelles Financial Supervisory Authority (FSA)

All of these authorities have a good reputation for upholding financial accountability among brokers. Your money will be safe. In case of any irregularities or unfair treatment, you can always take legal action through the regulatory authorities.

To confirm the IC Markets registration on these regulatory agencies, we check the registration number on each agency’s respective websites.

IC Markets became registered with the Seychelles Financial Supervisory Authority (FSA), in July 2019. The rules about brokering firms were changing and still are changing even today. Global regulations for CFD brokers are different.

By registering with the FSA, IC Markets is legally allowed to accept traders from outside Australia. The traders can access advantages that include high IC Markets leverage, which Australian clients enjoy.

To offer more protection, IC Markets does the following things as well:

They hold segregated accounts for client funds through Westpac Banking Corporation and National Australia Bank.

They bring in third-party auditors to check the books and compliance.

They are a member of the Australian Financial Complaints Authority.

They have segregated accounts for their FSA-regulated clients at Barclays Bank.

Our IC Markets review shows that the broker outstanding, except that they do not have investor compensation funds for clients with accounts overseen by FSA and ASIC regulation.

IC Markets Bonus for Deposits

Because of changing regulations across many jurisdictions, IC Markets bonus offers are not allowed. Some brokers encourage traders to sign up by offering to match the deposit bonus or a welcome bonus.

If you find any IC Markets bonus offers, you should check them out first before you click on them. It is better to get any rewards from the brokerage firm, instead of third-parties.

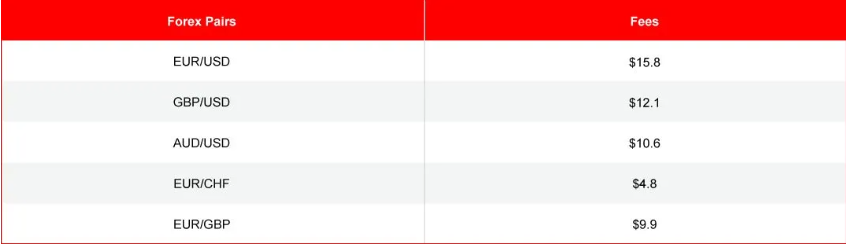

IC Markets Trading Fees

The cost of trading varies from broker to broker. Logically, any trader wants to get the most cost-effective way to trade. Our IC Markets review of the trading fees shows that they range in the same level as many of the competitors. However, it is always good to get the details.

Comparing the rates between two brokers is hard because of differences in account types and jurisdictions. To make the process smooth, we take a look at some of the common tradable currency pairs and CFDs, which all brokers offer.

Using the European cap IC Markets leverage of 1:20, a trader takes a $20,000 position on a stock index for one week before selling. These are the projected fees that the trader will have to pay:

When trading with this broker, the stock index CFD fees are included in the IC Markets spreads. The financing rates are higher than the competitors. Here is what a trader would have to pay in terms of financing fees when trading with IC Markets:

When trading with this broker, the stock index CFD fees are included in the IC Markets spreads. The financing rates are higher than the competitors. Here is what a trader would have to pay in terms of financing fees when trading with IC Markets: Using the leverage of 1:30 on the major currency pairs we mentioned above, the same trader would pay the following fees, if they took a $2,000 position for a week.

Using the leverage of 1:30 on the major currency pairs we mentioned above, the same trader would pay the following fees, if they took a $2,000 position for a week. Overall, IC Markets fees are not very different from other brokers, aside from the high financing rates.

Overall, IC Markets fees are not very different from other brokers, aside from the high financing rates.

As you will find out, non-trading fees are low. Account opening is free, and the IC Markets minimum deposit is set at $200. The details we gathered for this IC Markets review indicates that you will not have to pay inactivity fees, deposit fees, or withdrawal fees.

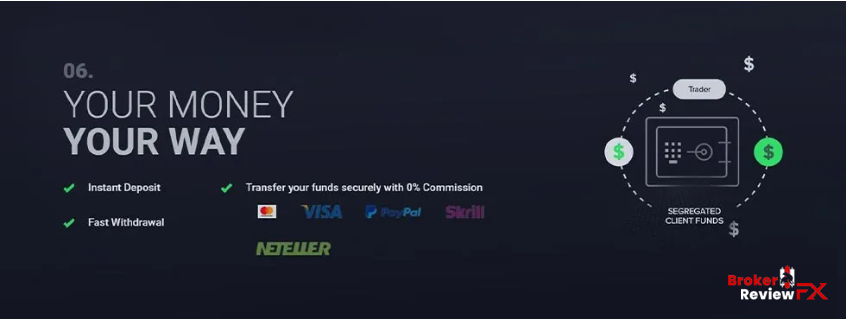

IC Markets Withdrawal Options

Depending on the method you use, your withdrawals and deposits are processed in 2 to 3 days. As we have mentioned, you will not have to pay withdrawal or deposit fees. The bank you transact with may charge you transfer fees, but the broker will not.

Because they are a regulated company, they do not manipulate market prices and are obligated by law to honor all the deposit and withdrawal requests sent to them. If they violate the regulations, you can make an official complaint with the relevant regulatory body overseeing your country of origin.

IC Markets Deposit Options

The deposit process is easy, with many channels for traders to use. They include:

- Bank wire transfer

- Credit and debit cards

- PayPal

- Neteller

- VIP

- Skrill

- UnionPay

- Bpay

- FasaPay

- Broker to Broker transfer

- Thai Internet Banking

- Rapidpay

- Klarna

- Bitcoin Wallet

- Vietnamese Internet Banking

With multiple options like these, traders can now choose the most convenient method for them. It makes the process of depositing funds and trading very easy.

IC Markets Account Opening

On IC Markets, the account opening process is quite easy and follows the same procedure as most brokers. The account will most likely be approved within a day. IC Markets live account accepts clients from anywhere in the world.

You will have the following base currencies to choose from:

- USD

- EUR

- AUD

- HKD

- NZD

- JPY

- CAD

- CHF

- GBP

- SGD

To get to the account you need, go to the IC Markets home page and click where it says ‘Start Trading.’ If you want the IC Markets demo account first, click where it says ‘Try a Free Demo.’

We recommend the free IC Markets demo for new traders who doesn’t have much experience. With it, you will be able to access the markets in real-time and virtual currency to train yourself and hone your strategies.

Clicking on the account creation button will direct you to an account registration page. There, you the steps you have to take to get the account. As usual, you will be required to provide personal details, your level of expertise, and any other relevant information, make account configurations, and then make a declaration.

When you are done filling the spaces, submit and wait for IC Markets to approve your account. After you get account approval, you will have access to the Secure Client Area, where you can fund your account and be allowed to start trading.

In the sign-up process, you will need to verify your address and identity. The broker will ask you to upload the relevant information that proves what you have filled in the form. The uploads for identification could be:

- A government ID

- State-issued ID

- Passport

The uploads for address proof include:

- Bank statements

- A recent and valid utility bill

- Any other official documents that confirm where you live.

Make sure that you read the IC Markets instructions to ensure that the upload you make is relevant. Sometimes, the requirements can differ from one broker to the other.

IC Markets Account Types

Account types are some of the reasons why brokers are different. The spreads, commissions, platforms, financing rates, and other important details, are usually included in the account descriptions.

Our research for this IC Markets review finds that you will get three main types of accounts to choose from.

Consider the trading costs, platforms, spreads or commission, and other relevant details to make the right choice. The three main IC Markets Account types are:

- The Standard Account (For MetaTrader)

- The Raw Spread Account (For MetaTrader)

- The Raw Spread Account (For cTrader)

For those who need IC Markets demo or swap-free accounts, the broker provides.

Here are the detailed looks at each IC Markets account and what you can expect.

The Standard Account (For MetaTrader)

The IC Markets Standard Account is best for discretionary traders, who like to use MetaTrader. All trading styles are allowed, meaning the account will not limit what you can and can’t do. There is an Islamic account, for users who require swap-free trading.

- The commission per lot: $0

- Spread: 1.0 pips

- Minimum deposit: $200

- IC Markets Leverage 1:500

- Micro Lot Trading (0.01) is allowed

- Stop Out level at 50%

- One-click trading and CNS, VPS Cross-connect available

The server used for this account is located in New York, which means traders experience low latency in execution speeds. Traders have access to multiple asset classes that include 64 currency pairs and Index CFDs.

Raw Spread Account (For MetaTrader)

This account is best for traders who wants to trade with expert advisors and those who prefer scalping. Because they allow all trading styles, you will not be restricted to some trading methods. In addition to that, Islamic account facilities are there too.

- The commission per lot: $3.5 and $7.0 per lot round turn.

- Spread: 0.0 pips

- Minimum deposit: $200

- IC Markets Leverage 1:500

- Micro Lot Trading (0.01) is allowed

- Stop Out level at 50%

- One-click trading and CNS VPS Cross-connect available

The server for this account type is located in New York and provides users with the speed they need, in terms of execution. It is also important to know the server’s location, so you know which one to connect to when on MetaTrader.

The cTrader IC Markets Account

IC Markets recommends this for day traders and scalpers. As with the other accounts, all trading styles are allowed here too. The cTrader accounts have swap-free provisions for Islamic traders who need them.

- Commission per lot: $3.0 and $6.0 per lot round turn.

- Spread: 0.0 pips

- Minimum deposit: $200

- IC Markets Leverage 1:500

- Micro Lot Trading (0.01) is allowed

- Stop Out level at 50%

- One-click trading and CNS VPS Cross-connect available

The currency pairs available on this account are 64, same as with the others, with Index CFD trading.

By looking carefully at each of the accounts and what they can offer you, it will be easy to decide which one works for you. It helps when you have a list of expectations to guide your choices.

IC Markets Platforms

IC Markets platforms are comprehensive and available across all devices. You will have two software options to choose from; MetaTrader and cTrader. You’ll be happy to know that cTrader is available for web traders and Algo traders.

MetaTrader clients can choose to get either IC Markets MetaTrader 4 or IC Markets MetaTrader 5 on the web, mobile devices, and desktop.

From the secure client area, you can download and use these platforms. To gain more insight into the platforms so you can pick the best one, we will get into some detail.

IC Markets cTrader

Combining speed and high-performance value, cTrader allows you to access deep levels of market liquidity. With it, you can trade all the 64 currency pairs available on IC Markets and the 16 major equity indices that they offer.

If you would like to trade with the superior functions offered by cTrader and stream prices from significant liquidity providers globally, this is the platform for you.

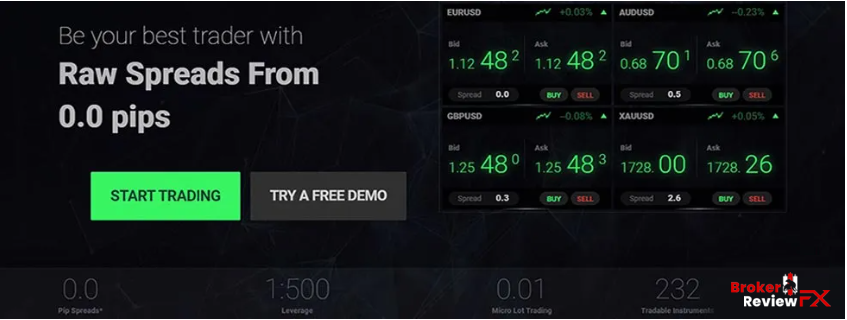

Tight Spreads

With the average spread of the EUR/USD pair at 0.0 pips on IC Markets, it is easy to see why the traders would like to use this broker. The average spread on the same pair from other providers is usually at 0.1 pips. When using cTrader, you can enjoy this type of cost-effectiveness.

Rapid Order Execution

The server at the London Equinix Centre makes IC Markets able to execute orders very fast when clients are on cTrader. The data centre ecosystem houses 600+ firms, ventures, exchanges, market data, and services from which a trader benefits.

Unrestricted Trading

You can scalp, hedge, and use any legitimate trading method that you like. There is no minimum on order distance, and the freeze-level on cTrader stands at ‘0’.

Access to Level II Pricing

The orders you make are filled against the full order, using VWAP (Volume Weighted Average Price). Clients can have transparency that allows them to see the forex pair liquidity and volumes of each price level. Nothing is kept out of sight.

Smart Stop Out Option

When you are trading, you need all the protection you can get. On cTrader, you will enjoy the maximum protection from an advanced algorithm that helps you as a stop-loss function.

In addition to all these features, you will enjoy additional features on IC Markets cTrader. They include:

- An expanded ‘symbols display.’

- Several ‘order’ types.

- CFD quotes and reports in real-time

You get a lot more when you are on cTrader, including bypassing a dealing desk. The costs are lower, the risk control is high, and you get to pick how much leverage you want.

IC Markets MetaTrader Platforms (MT4/MT5)

Both MetaTrader 5 and MetaTrader 4 IC Markets are available for download on Mac, Windows, Android, and iOS devices.

When using MT4, you will be able to access features like:

- Fast order execution

- Multiple timeframes and chart types

- Unrestricted trading

- More than 30 technical indicators

- Real-time quotes on CFDs and forex

MT5 users will have similar features as well as experience as MT4 users, with the added benefit of several upgrades and news features that come with the new version.

The additional features on MT5 include:

- Connections to Raw prices

- Spreads that start from 0.0 pips

- A view of the market of up to level II, complete with technical indicators

- Improved strategy testing for EAs and algorithms

- Automatic trading, powered by EAs and other tools from MQL5 community

It is best to find out which of the two MetaTrader versions you are most comfortable with. Sign up for the IC Markets demo account and test each one to see how you feel about them. After that, you will have no trouble choosing the one that works best for your strategies and style.

MT4 and MT5 Webtrader

The features you get on the desktop app are the same as when trading straight from the browser. You will not be missing anything when using the web trader. It is convenient for when you are on the go, using a laptop, and are unable to sit at a terminal.

Top IC Markets Additional Features

To pick the best broker, always look at the additional value that they bring to the table. Most of the other brokers have platforms and other features that IC Markets has, but there are unique features that set this broker apart. Here are some of them:

They have social trading

IC Markets allows clients to easily integrate the platforms they use, with social trading services. With the social forex trading platforms, beginners and experts alike can look at the trades of other good traders and learn from them. Making comparisons helps people learn faster.

High net-worth individuals are accommodated

With API trading, high net-worth traders can get direct access to liquidity providers who have deep liquidity pools.

Automated analytics

To gain insight into ideas, IC Markets traders can access the Trading Central section and get the best ideas. Not only will this make them better traders, but also improve their analysis skills.

IC Markets Commissions and Spreads

As we mentioned earlier, some of the accounts are commission-free, and others are commission-based. To get the full idea of how much you will pay, you need to look at which account you have and the financial requirements.

A look at the spreads shows the following trends.

- Forex

- Commodities

- Indices

- Metal

- Bonds

- Cryptocurrency

IC Markets Commissions

The commission charged on cTrader is per side, per 100,000 USD traded. That is different from MT4, where the amount is fixed per lot. The commission you will pay on the cTrader platform is $3 per 100,000 USD traded.

NOTE: The USD’s commission is converted to the base currency you chose when opening your account, using the current rates at the time of your transaction.

This table is accurate at the time of writing this review and shows how much commission you will have to pay, corresponding to each account base currency.

IC Markets Customer Service Experience

As with any broker, you could meet challenges and other issues that need addressing. To get it right, you may need to call, email, or text the customer support. You’ll be glad to know that they are prompt, accurate, and helpful.

The General Experience

IC Markets’ strategy is to market itself as the best option for high volume traders. However, their features are suitable for beginners and low volume clients too. If you pick the account that works best for your style and strategy, you should have no problem staying profitable.

With great spreads, demo accounts, a library, research material, great support, and other additional trading features, the trading experience at IC Markets gives traders a great environment to thrive.

The platforms are available across all devices (Mac and Windows) & (Android and iOS). To learn how to trade better or compare your strategy with that of your favorite traders, you can use the integration for social trading or copy trading, through Zulu Trade and MyFXbook.

You get to choose if you want to use a commission-based or commission-free account. As for algorithmic traders and scalpers, you’d be happy to know that there are no requotes and no restrictions.

The trading environment is generally a welcoming one that seeks to cater to every trader.

In Conclusion

One of the things in which IC Markets stands out is at the level of customer service. Because it is an international online broker, they provide clients with multilingual assistance 24 hours a day, five days a week.

As this IC Markets review has shown, you can get benefit from the many features that make them unique best forex broker.

IC Markets has a security system that protects your data via encryption. They excel at service provision, because of experience, after more than a decade in the industry.

With regulations from FSA, ASIC, and CySEC, the security of funds and legal operations are guaranteed. Because of their data centres in London and New York, traders can now get the best out of the fast executions.

They offer competitive services and provide a wide range of markets and advanced commercial platforms.

You can open an IC Markets live account by filling out the application form via the website and start enjoying your trading now.

IC Markets is the one of the best broker for traders of different expertise. The unique value proposition ensures that all traders have the best possible experience with advanced tools, great speed, and excellent support.

IC Market’s customer support is excellent and always provides quick and helpful customer assistance. They offer their clients the opportunity to trade an extensive range of assets with true ECN capability.

IC Markets is a one of the best trading platforms for beginners. It offers tight spreads, multiple trading instruments, and educational resources to help new traders get familiar with the financial markets.

Poor customer care I withdraw funds no any help I haven’t received my funds is not their profit my own funds.

I just can´t believe ICMarkets´s support team is so unprepared! Passed more than 24h and nobody solved the problem! How can someone claim a deposit was successfully done if the registry records shows the last deposit was done in 22 October and the claimed deposit is referred to 23 October(as shown with bank receipt to prove!)

Conclusion: because of this completely disregard, I lost US188.00 plus my R$500,00(BRL) last deposit , that simply just was gone! Got out from my bank account and ICM says it is on my balance broker account, but it´s invisible.

You don’t have explained the withdrawal problems that this broker will cause you. IC Markets I think is some kind of scheme. I am in the small fraction of people that win money in their IC Markets account (and enough) and you cannot imagine the amount of excuses they give me for not doing withdrawls.

In brief, good for operate quicky and very bad swap fees (forget it you about keep open orders overnight!!)

Very easy to fund your account. But a nightmare for withdraw your funds, forget about your money for a long time.

They don’t accept Wire transfer to US

They are scamming you with their spread. Every day when they want they are giving you from one moment to the other a 200 spread and rip all of your money.

Most bad broker they gonna open the spread 100$ bitcoin 40 pips nzd pairs just to close Your position. I had good time before but now i will close my account and all my friends and Co works account.

All reviews here fake. Keep away from this broker, You cant whitdraw profits . They are making it absolotely impossible to whitdraw. None of the methods works and you cant add a bank account, this option is only there to trick you. Go and check it out so you know what I mean.

Scam Scam Scam Scam broker , You can deposit but NO WITHDRAW

I reach on with them , but didn’t get any response , they don’t have support system like xtreamforex. I daily ask on the live chat about my query but they message just like a robo….., so i have left this broker due to bad support