In the intricate world of forex trading, pips and pipettes stand as fundamental concepts every trader must understand to navigate the ebbs and flows of currency markets successfully. These terms are the building blocks of forex trading, representing the smallest units of price movement in currency pairs, and understanding them is crucial for managing risk and strategizing trades.

What are Pips in Forex Trading?

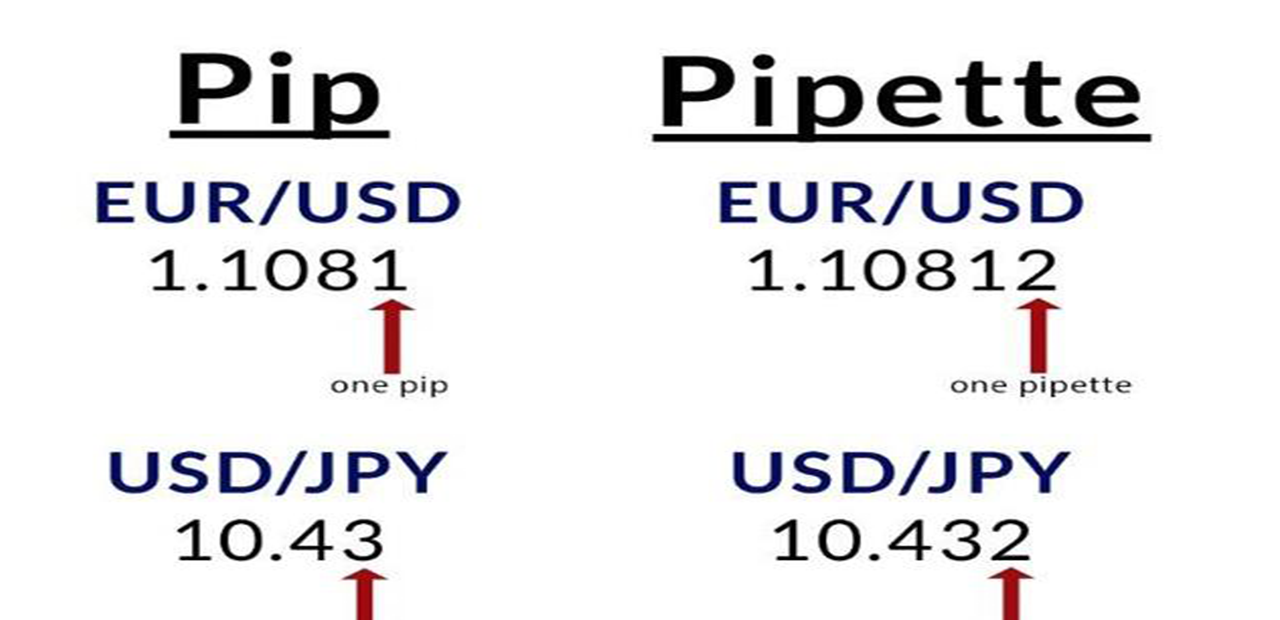

A pip, short for “percentage in point” or “price interest point,” is typically the smallest price move that a given exchange rate can make based on market convention. In most currency pairs, a pip is equivalent to a one-digit movement in the fourth decimal place of a currency pair. For example, if the EUR/USD pair moves from 1.1050 to 1.1051, that 0.0001 USD rise in the EUR/USD price is one pip.

In forex trading, pips are used to express the change in value between two currencies. So, if a trader says that a currency pair moved by 50 pips, it means that there was a 50-point movement in the price of the pair.

The Role of Pipettes

To bring even more precision to the forex market, we have pipettes, which are a fraction of pips. A pipette is thus the fifth decimal place in most pairs, or the third decimal place when dealing with pairs involving the Japanese yen. Essentially, a pipette is equal to one-tenth of a pip. For instance, if we take the previous example of the EUR/USD moving from 1.10501 to 1.10502, the change would be one pipette.

Why Pips and Pipettes Matter

Understanding pips and pipettes is vital for traders. This is because they determine the spread, calculate profits and losses, and standardize price quotes across brokers. They are integral in developing trading strategies and executing trades.

In the highly leveraged setting of forex trading, minor price fluctuations can result in substantial profits or losses. Thus, keeping track of pips and pipettes can help traders manage their positions more effectively.

Checking Broker Reviews

When it comes to forex trading, not all brokers are created equal, and the terms they offer can vary greatly. That’s why it’s crucial to check broker reviews at platforms like Broker ReviewFX. These reviews can provide insights into a broker’s reliability, the spreads they offer, their trading platform features, and much more. Reviewing brokers carefully helps traders find one that matches their trading approach and goals.

Calculating Value

The monetary value of each pip depends on three factors. These are the currency pair being traded, the size of the trade, and the exchange rate. A standard lot in forex is typically 100,000 units of the base currency. Therefore, the pip value for one lot of EUR/USD at an exchange rate of 1.1050 would be $10.

To calculate the value of a pipette, simply divide the value of a pip by ten. In our example, this would mean a pipette is worth $1.

In conclusion, pips and pipettes are essential components of forex trading. Understanding pips and pipettes helps traders accurately track profits and losses for better-informed trading choices. As with any aspect of forex trading, education and due diligence, such as checking broker reviews at Broker ReviewFX, are paramount to success in the forex market. For both new and experienced traders, a thorough understanding of pips and pipettes is crucial. It’s a fundamental step in mastering the nuances of the forex trading landscape.

0 Comments