Axi Review | Trade with a Trusted Broker

From humble beginnings in 2007, Axi has rapidly grown to encompass a large portion of the forex market. Our Axi review found out that they offer one of the best trading platforms globally and other unique features.

The London-based brand of Axi launched in 2012, and when they expanded by 2015, they had hit $100 billion in monthly volume moved by clients.

Currently, the Axi brand is regulated in the UK by the FCA under the London Company AxiCorp Limited brand. ASIC also regulates them in Australia under the name AxiCorp Financial Services Pty Ltd.

The regulation is further expanded to other regulatory agencies in multiple jurisdictions. It is safe to say that Axi is the best forex broker with a great reputation, making them an excellent choice for both learning and expert traders.

In 2016, AxiCorp announced that it had received a significant strategic investment from RGT – a leading Australian private equity firm. The goal of this initiative was to help drive its global growth. It is how they can offer services across so many countries.

At the moment, over 100 countries are eligible to trade with Axi. Right now, they host over 40,000 traders with 8 offices around the world to ensure smooth sailing.

Axi Quick Summary

| 🏢 Headquarters | Australia |

| 📆 Established | 2012 |

| 🗺️ Regulation | FCA, ASIC |

| 🖥 Platforms | Only MT4 |

| 📉 Instruments | Forex, Commodities as well CFDs and Indices, Bitcoin |

| 💳 Minimum Deposit | $1 |

| 💰 Deposit Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller, China Union Pay, FasaPay |

| 📱 Mobile Trading | Available |

| 🌍 Web Trading | Available |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | 1:400 |

| 🌍 ECN | Available |

| 🤖 Robots | Available |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/5 |

Axi Regulation

Axi has a solid reputation, even though there are some issues with the license in Australia and the subsidiary regulated in St. Vincent and the Grenadines. AxiCorp Financial Services is the parent company and owner of all subsidiaries operating under the Axi name.

Until January 2020, Axi was regulated by ASIC. However, their license was suspended over some issues, and the broker appealed. They continue to operate, pending a resolution for this case.

The Axi subsidiary that is regulated and authorized in St. Vincent and the Grenadines is the one that is supposed to be for international clients. In our Axi reviews, we make a point of checking the claims made by brokers.

A search on St. Vincent and the Grenadines website for Commercial Intellectual Property Office did not return any results for Axi.

However, in general, the broker seems to have a great reputation. The license issues are probably temporary as the broker continues to enjoy success and great reviews from clients and industry experts.

The theory is that this is an oversight by the company. If you feel any additional concerns, you should call in and talk to them about this. They will likely offer a good explanation for it. Other than that, they seem to take client trust very seriously.

Axi Bonus for Deposits & Promotions

Many of the regulations imposed by the regulatory agencies overseeing Axi, have everything to do with client protection, among other reasons. One of the new introductions in the rules involves restricting brokers from offering bonuses to clients.

There is no official mention of any Axi deposit bonus or promotion of that kind. The reason for that is legal compliance. If you find anyone offering a bonus in the name of Axi, you would be wise to ignore it. Scammers always pretend to be from a legit broker and try to con people.

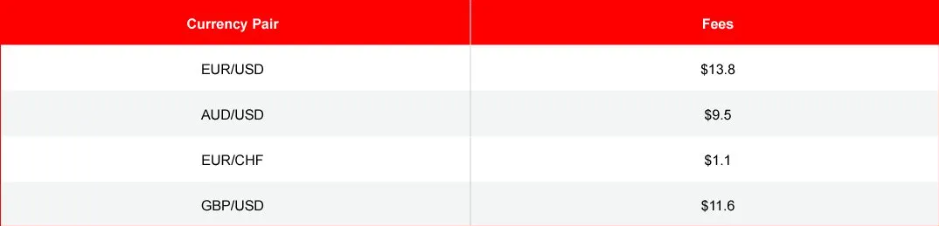

Axi Trading Fees

When comparing the trading fees between brokers, we always have to consider the most important things. We will look at the leverage, commission, and spreads that you will find when trading with Axi.

There is a lot to like about their fee structure. To get a clear look that contains everything that you need to know, we have to look at the details of how much you would have to pay if you were trading.

We will select specific products, leverage each of them, and determine how much you will have to pay if you sell after a week. So, here are the products we are going to look at:

- Currency pairs: EUR/USD, AUD/USD, EUR/CHF and GBP/USD

- Stock index CFDs: EUSTX50 and SPX

For forex, we are going to choose a volume of $20,000 and then a volume of $2,000 for stock indexes.

Axi Financial Instruments

Traders can diversify and do more when they have access to great markets and financial instruments. The selection at Axi is somewhat limited when you compare them with other brokers on the same level.

However, they provide instruments in forex, stock indices, and crypto CFDs. However, they do not have Stock and ETF CFDs.

The best part about this broker is that you can CHANGE LEVERAGE when you want to. This useful feature allows you to have a firm handle on how much you want to risk and how much you stand to lose.

Instead of using the 1:5 leverage on stock indices, you can lower it to something like 1:3 and only be exposed to a manageable risk. If you lose, then you know that you are losing the amount of money you can afford.

Always check the pre-set levels of leverage on forex and CFDs, as it is usually high.

Axi Minimum Deposit, Withdrawal and Deposit Options

Through its Australian entity, Axi requires a minimum of $500 deposit for Australian residents to open a standard account. However, non-residents have to deposit a minimum of $1,000. In the British unit, there is no minimum level for either the standard or the PRO.

You will get many options for depositing and withdrawing your money. As we have outlined in this Axi review, there is a lot to like about the company. The options include:

Credit/debit cards and bank wires: clients choose Skrill, Neteller, China Union Pay, FasaPay, Thai International Banking, Vietnamese Instant Banking, and Polish Instant Banking.

Withdrawing takes 2-5 depending on the method you use. Over time, the broker has promised to introduce instant payments that can be made directly to your phone.

Axi Account Opening

Axi is overseen by strict regulatory rules that require clients to fulfill compliance checks. The checks ensure that you are safe and legible for trading. The FCA and ASIC require the broker to ask you for some documents before giving you an account.

So, as you prepare to open your Axi account, make sure that you have the following things:

A colour copy of your national ID, state-issued ID, passport, driving license, or other official identity documents. They are used to prove your identity.

A bank statement or utility bill that is no older than three months, showing your address clearly. These documents are used as proof of the address you provide and ensure that you live in the country you indicated.

After you deliver these documents, you will be asked to answer some compliance questions that confirm how much you know about the market. It will take about ten minutes for you to finish the account opening process.

Before you start opening an account with this broker, you need to make sure that you know enough about the markets and how they work. Otherwise, you will not be able to answer the questions they ask.

If you get someone else to do it for you, that will only hurt you when the trades finally fail.

Because of the rigorous Axi regulation and compliance process, it might take a few days to determine whether you passed or not.

Axi Account Types

Like any of the reputable and successful brokers, Axi provides you with a demo account that will allow you to familiarize yourself with how it all works. They mainly use MT4 as the standard account of choice.

Traders can choose from two Axi account types. There’s the Standard account and the Pro Account.

The Standard Account comes with higher spreads and no commission charges. The Pro Account has raw spreads and commission included.

In comparison, the Pro Account trading experience is better than the Standard Account. However, it all comes down to what you require to be effective.

The maximum Axi leverage is 1:500 because Australia is one of the few countries where leverage has not been capped yet. In Europe, for instance, the leverage is capped at 1:30. The main features you will find in both accounts include:

- Quote accuracy of up to the 5th digit

- Hedging and scalping are allowed.

- MT4 is the platform provided

- The minimum trade sizer per lot is 0.01

- You are provided with a 30-days free demo platform to train yourself.

The Standard Account spreads start from 1.0 pips, and the Pro Account spreads start from 0.0 pips.

Axi Education and Research

Most of the research you would have to do is done by the Autochartist plugin and PsyQuation Premium tools. That is alright. If you need more tools to do your research, you can look through the market analysis section of the Axi website.

They post great content that included market commentaries that give traders all kinds of ideas on how to think about the trades. If you combine that with what is provided by the Autochartist plugin and the AI-based PsyQuation Premium tool, you end up with a package that can get you through most trades.

Even the education part is outsourced to the PsyQuation Premium platform that alerts you to mistakes while trying to make you a better trader. However, that is not all there is on Axi. If you want to learn more, you can access additional information.

There are educational articles, video tutorials, online courses, and eBooks.

All these provisions come together to ensure that new traders can learn what they need to know before signing up for an account.

Remember, we mentioned that the compliance checks at Axi are strict. In addition to that, you should always make sure that you know what you are doing before you get into the forex market, for your good.

Axi Customer Service Experience

There are three ways to get connected to Axi. You can use:

- Website live chat

- Telephone numbers

The live chat is the fastest way to get in touch with Axi representatives. The relevance of answers is all customers care about when dealing with customer service. You will be happy to know that they have the correct and full answers to your questions.

In addition to these methods, they also have a comprehensive FAQ section covering most of the common questions you may want answers to.

The best part is that the broker manages everything well that you won’t need support most of the time.

The only thing about the service that is a drawback is that they are only available 5 days a week

In Conclusion

Our Axi was created to find out how suitable this broker is to you. They are regulated by respected agencies like FCA, ASIC, and DFSA. With all of these requirements and compliance measures, safety is ensured.

Axi’s online platform, designed to serve its customers, unfortunately presents a series of significant challenges, primarily centered around its poor quality and user interface design. One of the most glaring issues is the difficulty in updating or upgrading credit card information. This should be a straightforward, seamless process in today’s digital age, yet Axi’s platform makes it a cumbersome and time-consuming task.

The frustration is compounded when seeking assistance from their customer support team. In my experience, the support team, though possibly well-intentioned, was unable to resolve this basic issue. This ineffectiveness in customer support not only extends the duration of the problem but also reflects poorly on the company’s overall operational competence.

Time is a valuable asset, particularly in the fast-paced digital world, and Axi’s inability to provide efficient solutions is a significant drawback. As customers, we expect digital platforms to enhance our efficiency, not detract from it. The time lost in trying to navigate their platform and the additional time spent in unsuccessful communication with their support team represents a cost that customers should not have to bear.

Moreover, this issue is indicative of a larger problem within Axi. The saying, “The way you do anything is the way you do everything,” seems apt in this context. The lack of attention to detail and customer-centric design in their website platform suggests a half-baked approach to their operations. It raises questions about their commitment to quality and efficiency in other areas of their business.

In conclusion, my experience with Axi’s website platform was underwhelming and filled with unnecessary hurdles. The difficulty in executing simple tasks, coupled with ineffective customer support, paints a picture of a company that may not be fully prepared to meet the needs and expectations of its customers in a digital-first world. This experience was not just a one-off inconvenience but a telling sign of a possibly systemic issue within the company. It’s a reminder that in the digital age, companies cannot afford to overlook the importance of a well-functioning, user-friendly online platform.

I’m deeply frustrated with my experience with Axi, as they seem to be making it incredibly difficult for me to access my own money. It’s disheartening to say the least. When I tried to withdraw my funds, I encountered a series of issues that have left me feeling like I’m caught in a never-ending loop of obstacles.

One of the most exasperating problems is Axi’s tendency to cancel withdrawal requests without any prior notice or explanation. This abrupt cancellation leaves customers like me in the dark, wondering what went wrong and why our requests were denied. It’s not only confusing but also incredibly inconvenient.

To make matters worse, when Axi doesn’t cancel the withdrawal request, they often try to frustrate customers by demanding reasons for the withdrawal. This feels like an unnecessary invasion of privacy and adds an extra layer of complexity to a process that should be straightforward. Additionally, Axi has rejected my previously approved banking information, claiming it to be incorrect. This is particularly perplexing, as the information provided was accurate and had been previously accepted by them.

I can’t help but wonder if there’s something more sinister at play here. This kind of behavior raises concerns about the integrity and trustworthiness of Axi as a regulated broker firm. It’s essential for customers like me to have confidence in the financial institutions we deal with, especially when it comes to accessing our hard-earned money.

I sincerely hope that Axi addresses these issues promptly and releases my funds so that I can transfer them to a more reliable and trustworthy platform like Assurity Secure. Trust is paramount in the financial industry, and Axi must prioritize its customers’ needs and ensure a smooth and hassle-free withdrawal process. It’s time for them to prove that they are a reputable and customer-centric organization.

I’m sharing my experience as I signed up for the Axi affiliate program, and it hasn’t been a pleasant one. The part that bothered me the most was the ID upload and verification process. I had to submit my ID twice, but even after doing that, my verification wasn’t completed. This has been quite frustrating for me.

What’s even more frustrating is the communication with Axi’s support. Their WhatsApp account seems to be of little use, and they take an incredibly long time to respond to emails. It feels like they only respond when it’s not a complaint. In the past, Axi used to be known for its efficiency in responding to clients, and it was one of the reasons I chose them. However, now, it seems like they’re no different from other brokers in terms of customer service.

The ID verification process used to be quick at Axi, often taking less than 5 hours. But now, it feels like it takes forever. Similarly, emails used to receive prompt responses, and the WhatsApp account was quite helpful. I can’t help but think that maybe Axi needs to hire new, more effective employees to get back to their best.

I genuinely hope that Axi can improve in these areas and return to providing the excellent service it was known for. As a customer, I value efficient communication and timely verification processes, and I believe many others do too. It’s crucial for Axi to address these issues and regain its reputation for being a reliable and customer-friendly broker.

In my experience, Axi is a broker that has both positive and negative aspects. On the positive side, they have good customer service, and I feel that my investments are secure with them. However, there are some downsides that I’ve encountered. One of the main issues is the occasional poor internet connection when I’m trying to do scalping. It can be frustrating when you’re in the middle of trading, and the connection slows down or drops. This can potentially lead to missed opportunities or losses, which is not ideal. Another thing that didn’t sit well with me is their request to write a positive review in exchange for a chance to participate in a “lucky draw.” I believe in giving honest reviews, and I didn’t feel comfortable being asked to write a positive one just for a contest. So, I decided not to do it. To express my decision, I replied to their email. To my surprise, my email was blocked from their client service email. This left me feeling frustrated and disappointed. It’s important for a broker to respect the feedback and choices of its clients, and blocking emails for expressing a genuine opinion is not the kind of customer service I expect. In conclusion, while Axi has good customer service and offers security for investments, there are areas where improvement is needed. The issue with poor internet connection during scalping can impact trading experiences. Additionally, the request for positive reviews and the subsequent blocking of emails for expressing honest opinions raises concerns about their approach to customer feedback.

I’m unable to share a screenshot, but I want to share a concerning experience I had with Axi. I have a PAMM (Percent Allocation Management Module) account with Axi, and I decided to invite my sister to join this investment opportunity. Initially, everything was going smoothly, and we were optimistic about the potential returns. However, what transpired next left us both shocked and frustrated.

Out of the blue, all the funds in my sister’s account disappeared. It was as though her hard-earned money had evaporated into thin air. When we checked her transaction history, we were met with a disheartening sight – every entry displayed a balance of 0.00, from the initial deposit to any subsequent withdrawals. It was as if her financial contributions had been wiped from existence.

This abrupt and unexplained disappearance of her funds raised serious concerns. To me, it felt like a textbook example of what one might consider a scam. It’s incredibly disheartening to place trust in a financial institution like Axi, only to encounter such inexplicable and distressing situations.

In the world of finance, trust is paramount. When entrusting a company with your hard-earned money, you expect transparency, reliability, and integrity. Unfortunately, this experience with Axi has cast doubt on their credibility.

I feel compelled to share this experience as a warning to others. It’s crucial to exercise caution and conduct thorough research before placing your trust and funds into any financial institution. My hope is that by sharing this story, I can help others avoid similar ordeals and navigate the world of investments with greater prudence and awareness. Trust is earned, and it’s essential to ensure that the companies we engage with are deserving of that trust.

I had a really bad experience with Axi that I want to tell you about. It’s honestly the worst one I’ve ever come across. Here’s what happened.

I signed up with them, all excited to start trading, but then I couldn’t log in anymore. It was so frustrating! The system was asking for my Mt4 credentials, but I couldn’t even get into my dashboard to set up my Mt4 account. It made me think, what if this had happened when I was in the middle of live trading? That would have been a disaster! It’s really urgent that they fix this problem.

I don’t think I can trust this forex firm anymore. They seem to have some serious issues with their system. And their customer support is just as bad. When I reached out to them for help, they took forever to reply, and when they did, their responses were not professional at all. It’s like they didn’t care about my problem.

In the world of forex trading, trust and reliability are super important. You need to know that the platform you’re using is stable and that you can count on the support team when you have issues. Unfortunately, this firm doesn’t seem to meet those standards.

I wanted to share this experience with you so that you’re aware of the problems I faced with this forex firm. It’s essential to choose a reliable and trustworthy platform for your trading activities. I hope my story helps you make a better decision when it comes to choosing a forex firm to work with.

I’ve been a customer of AxiTrader Limited (AxiTrader) for quite a while now, since 2014 to be exact. Recently, I’ve been trying to withdraw my funds from my account, and it’s been a real struggle. I wanted to share my experience with you.

I thought it would be a straightforward process to get my money within two weeks, but it hasn’t turned out that way. Instead, the company seems to be doing everything possible to delay the process. They’ve been making promises and giving me information that turns out to be false.

One of my main requests has been for them to provide me with confirmation that they’ve sent my money using something called SWIFT. It’s a standard way to transfer money internationally, and I wanted some proof that the process was in motion. But guess what? They’ve refused to give me this confirmation, and that’s left me feeling really uneasy.

What’s even more frustrating is that they’re not responding to my messages. I’ve been trying to get in touch with them to understand what’s going on and when I can expect my funds, but it’s like I’m talking to a brick wall.

As someone who’s been with AxiTrader for several years, this experience has been disappointing and quite stressful. I trusted them with my money, and now I feel like I’m having a hard time getting it back.

I wanted to share my story to make others aware of my situation with AxiTrader. It’s essential to consider the reliability and responsiveness of a company before you trust them with your money. I hope my experience helps others make informed decisions about their financial dealings.

Losing money in trading can be pretty easy, especially when you’re dealing with some not-so-great conditions like offered at Axi. Let me explain what I mean.

First of all, there are these things called spreads. Spreads are like the gap between the buying price and the selling price of a financial asset, like a currency pair. When spreads are really big, it means you have to pay more when you buy and get less when you sell. That can eat into your profits right away.

Then there’s this issue with take profit and stop loss levels. Take profit is like a target where you want to sell your asset to make a profit, and stop loss is a level where you want to sell to prevent losing too much. Sometimes, these levels aren’t set up in the best way. For example, you might have a take profit level that’s not very high, which means you don’t make as much money as you could when the price goes up. But on the flip side, your stop loss level might be set too low, so if the price goes down just a little, you end up losing a lot of money.

It’s like you’re trying to make more money, but the system is not really on your side. And sometimes, the quotes or prices you get from the market are not in your favor either. So, when you’re trading, it’s important to watch out for these things.

In the end, trading can be tricky, and you need to be careful about the conditions you’re trading under. It’s not just about making money; it’s also about protecting what you have from big losses. So, keep an eye on spreads, set your take profit and stop loss levels wisely, and be aware of the quotes you’re getting to have a better chance of success in the trading world.

I’ve been trying to figure out why it’s been such a challenge to grow my $500 trading account with Axi. It’s been really puzzling, and I’d like to share my experience to see if someone can help me understand what’s going on.

Here’s the thing: Every time I make some profit on a trade, something strange happens right around midnight, specifically between 11:45 PM and 12:10 AM. It’s like clockwork. I check my account, and I see that almost all of the profit I made earlier is suddenly gone. It’s not because of swap fees or commissions; those aren’t the culprits here.

I’ve tried to do some research to get to the bottom of this, but I haven’t been able to find a clear explanation for why this keeps happening. It’s really frustrating because I’m doing my best to make smart trades and grow my account, but it feels like something mysterious is taking away my gains right when I’m not watching.

I’m hoping that someone with more experience or knowledge about trading can shed some light on this situation. It’s important for me to understand what’s happening so that I can make better decisions and hopefully avoid these unexplained losses in the future. If anyone has insights or explanations, please share them with me. I’m eager to learn and improve my trading experience with Axi.