InvestMarkets Review: Are You Being Lured into A Scam?

Online brokers promise that you can mint thousands or even millions of dollars trading through their platforms. In reality, most people make a net loss, partly because they do not know about the markets and sometimes because they fell for a scammy broker.

You can save yourself the heartache by checking out brokers thoroughly before investing. To start you off, we have done this InvestMarkets review to help you assess if it is a scam or genuine broker.

If you have already lost your money to a thieving broker, there is still hope if you act now. Book a free consultation session today for guidance on how you can recover the lost cash.

InvestMarkets Review: About InvestMarkets

Founded in July 2020, InvestMarkets is barely one year into the business. But there’s a catch that we’ll talk about shortly.

The parent company, Arvis Capital Limited, is registered in Belize, where its headquarters are located. It is licensed and regulated by Belize’s International Financial Services Commission (IFSC).

Some review sites claim the site is currently not accepting registration of new traders, but this is erroneous reporting. The site is active, and new traders can register.

However, you cannot register with InvestMarkets if you are currently in the United States of America, the European Economic Area, Canada, or British Colombia.

This is probably a sign that the broker does not meet the regulatory requirements to operate in those regions.

If you are successful in your registration, you can trade various assets through the broker, including currencies, stocks, commodities, indices, and cryptocurrencies. But read on before you do that.

So, where’s the catch? Well, InvestMarkets is not really new. It was formerly 24Option, a regulated scam forex trader that was banned by the FCA and shut down in 2020. It quietly rebranded to InvestMarkets. If you log in to your 24Option account, you’ll be redirected to InvestMarkets.

InvestMarkets Trading platforms

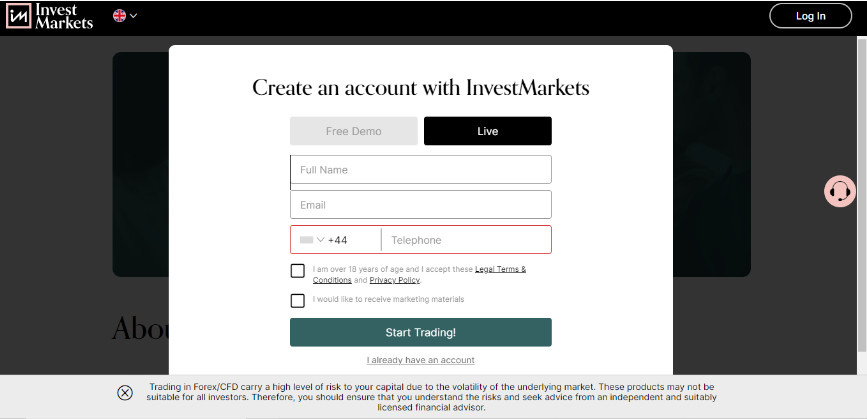

Registered InvestMarkets traders can trade on the MetaTrader 4 platform or the broker’s proprietary webtrader platform. Both platforms are available on mobile phones.

With the MT4 platform, you can open a demo account to practice on before committing your money to a live account.

The same applies to the InvestMarkets webtrader, but they offer an even better deal; you don’t need to be registered with the broker to download the webtrader. However, it allows manual trading only. Therefore, you can’t use signals and indicators to manage your trades.

Overall, if you are a newbie, the demo account options offered by InvestMarkets are an excellent channel for you to learn and practice. It provides:

- Educational material

- Webinars

- Customer support through email and calls

You can upgrade once you have gotten the hang of it.

Types of Accounts

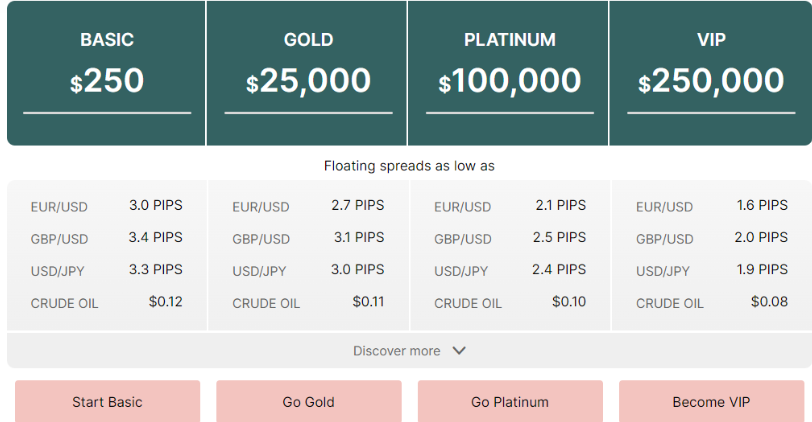

InvestMarkets offers four types of trading accounts, which mainly differ on spreads and required minimum deposit amount.

The accounts are Basic, Gold, Platinum, and VIP.

1. Basic

The Basic account has the lowest minimum deposit requirement — $250. Its lowest floating spreads are the highest compared to other accounts, e.g., 3.0 pips for EUR/USD currency pair, 3.4 pips for the GBP/USD, and $0.12 for crude oil.

The maximum leverage allowed for this account is 1:500, which is only possible because the Belizean authorities regulate the company. In territories such as the USA and the European Economic Area, the leverage is capped at 1:30. It is requirements such as these that have made the broker run away from regions whose regulations favor the trader.

You also get only one free withdrawal with this account type.

2. Gold Account

The Gold account requires a minimum deposit of $25,000. The account’s lowest spreads are slightly lower than the basic account, but still exorbitant at 2.7 pips for EUR/USD currency pair, 3.1 for GBP/USD pair, and 0.11 for crude oil.

On the Trading Platform, you get access to Market Buzz, Analyst Views, Featured Ideas Economic Insight, Daily Market Analysis, and Web TV. All these are available in all account types, including Basic.

For a Gold account, you can withdraw free of charge once a month.

3. Platinum Account

The minimum deposit for the Platinum account is $100,000. The spreads and fees are considerably low compared to Basic and Gold accounts. The spreads for the EUR/USD currency pair start at 2.1 pips, 2.5 for GBD/USD, and $0.10 for crude oil.

The Platinum account owners also have the prestige of free withdrawals three times a month.

4. VIP Account

At $250,000, the VIP account has the highest minimum deposit. However, it also offers the best spreads, as low as 1.6 pips for the EUR/USD currency pair. These spreads are almost half of those offered on the Basic and Gold accounts. For the GBP/USD, the spreads start at 2.0 pips, and for crude oil, it’s $0.08.

You will also not be charged any fees to withdraw from the VIP account.

Now that you know the basics about InvestMarkets, here are some reasons why you should NOT deposit your money.

The Regulatory License Does Not Inspire Confidence

In regions with strong regulations and authorities, you can easily report a scam broker and get your money back. Such countries are categorized as tier-1 and tier-2 regions and have strong policies to protect the trader. They include countries such as the USA, Canada, Australia, and the European Economic Area.

To avoid such strict regulations, brokers that intend to scam traders register their companies in countries without solid policies on companies that offer financial services.

Belize is, unfortunately, one of those countries. If you have a dispute with a broker registered in such territories, it is much harder to claim your money than in the areas where financial services providers are well regulated.

InvestMarkets’ decision to register and operate from Belize seems questionable, especially when the broker purposefully avoids clients from well-regulated regions.

The Legal Theft

Brokers can steal your money legally by charging high fees and wide spreads.

Basic accounts should ideally be suitable for retail and new traders to practice day trading and scalping. However, Investmarkets’ high spreads in the Basic account and withdrawal fees make it almost impossible to scalp profitably. But most new traders don’t know that, so they lose lots of money before realizing they are in a rigged setup.

An InvestMarkets review also reveals that the broker charges very high fees on inactive accounts:

- 80 Euros for two months of inactivity

- 120 Euros for six months

- 500 Euros for 6-12 months

- 1000 Euros for accounts that have been inactive for over one year

In addition, the charges to reactivate the account may go as high as 2000 euros.

Dubious Luring Tricks

InvestMarkets promise not to charge commissions when trading. That’s good, only that they negate the benefit by charging high withdrawal fees. These fees are incredibly high for retail traders who use the Basic account. The no-commission feature is, therefore, a ploy to lure you into depositing your money.

Secondly, the broker makes it easy for you to deposit without completing all the necessary details. What’s the harm in that? This is a common trick used by scam brokers. Once they receive your withdrawal request, they ask you for an overwhelming amount of personal financial details. This delays, or totally blocks, your withdrawal request.

Getting the money in such a scenario can be challenging if you try to go about it alone. So instead, consult a Cipher Forensics expert to guide you on the legal avenues you can use to get a refund.

The 24Option Factor

InvestMarkets is a clone of 24Option. The troubled 24Option broker was banned by the FCA for unethical practices. Some of its terrible practices included:

- Excessively calling users to deposit money

- Noncompliance with regulations that saw it banned by Cosnob. FCA, and even the French authorities

- Withdrawal delays

- Poor customer support

Eventually, these red flags became the end of 24Option. It later rebranded to InvestMarkets and started the vicious circle all over again.

InvestMarket is Stealing Your Money, Using Their Rules

Any broker that takes advantage of legal loopholes to retain your money is not trustworthy. InvestMarket is a bad-faith actor luring traders to deposit their cash then finding ways to keep it. Their decision to register in a territory with loose regulations and avoid the regions that protect traders reinforces this assertion.

But even with their effort, you can still reclaim any money such brokers have taken from you using dirty tricks. Contact us today for a free consultation session. Our legal experts with years of experience can help you recover lost money.

Now i am very okay, just a couple of months ago i was in the deepest mess i kinda got myself in, by trusting a Lady i met online and somehow she convinced me she was a trader and could teach me how to trade and got me to invest alot and i emptied my insurance funds into the trading account and lost everything. it almost was one hell of a year, not until i met Kayline my highschool friend who introduced me to her brother who worked with a recovery firm. He took my complaints thesame week and we got through it within 22 hours. I got everything i lost recovered and told my husband about it. it was a wonderful feeling and reliving. i will drop the contact of the agency here as i promised them if they recovered my fund incase someone ends up in thesame mess i was in..

I lost money to a fraud trading platform, I will recommend the help of ( cybertecx net ) I got my lost investment funds back through their reliable service without an upfront fee. They are trusted recovery consultants that you can trust for complete guidance and help in the path of recovery.