Investous Review: Is Investous a Scam CFDs and Forex Broker?

Is Investous a scam, or is it legit? Is Investous regulated, compliant, and safe to invest with?

Nowadays, unscrupulous brokers lure in unsuspecting forex traders with stunning websites and irresistible offers. Selecting a legitimate broker is crucial for forex trading, and it will save you lots of heartache and losses.

This in-depth Investous review will give you the insight to ensure you don’t lose your funds.

If you’ve invested with Investous or any other forex broker and lost cash, don’t worry. Simply book a free consultation with Cipher Forensicss and learn how you can get your money back.

Investous Review: An overview

Investous is a fairly new brokerage in the forex market. It offers CFD trading on 300 plus financial instruments in four different asset classes.

IOS Investments Limited, an investment firm in Belize, runs Investous under the site investous.com/international. And an entirely different company called Leveltime Services Ltd in Cyprus processes transactions for IOS Investments Ltd.

The site investous.com/eu is run by an investment firm in Cyprus called F1 Markets Limited. It seems to have two arms, one targeting the international market while the other is targeting the European market.

Despite this deduction, Investous has a regional restrictions disclaimer on its website stating it doesn’t offer services in the European Economic Area or other jurisdictions like British Columbia, the USA, Canada, and other regions.

Investous regulation

Two different regulation bodies regulate the two parent companies running the two arms of Investous. Yes, it’s that confusing and ambiguous.

IOS Investment Limited is regulated and authorized by the International Financial Services Commission of Belize (IFSC). On the other hand, F1 Markets Limited is regulated and authorized by the Cyprus Securities and Exchange Commission (CySEC).

The ambiguity plus the fact that Investous is regulated by offshore regulators already raises a red flag. Nearly all fraud brokerages that offer services to international audiences are unregulated or find a haven in offshore countries.

You can’t compare an offshore regulator like the IFSC with the FCA in the UK or the NFA in the US. IFSC simply lacks the capacity, funds, and resources to oversee an internationally operating broker like Investous.

Therefore, nothing is stopping Investous from getting away with fraudulent activities as they operate under the guise of an offshore license.

Nothing protects UK forex traders at Investous. The IFSC doesn’t have strict rules or participation in compensatory schemes for insuring your funds against fraud and bankruptcy.

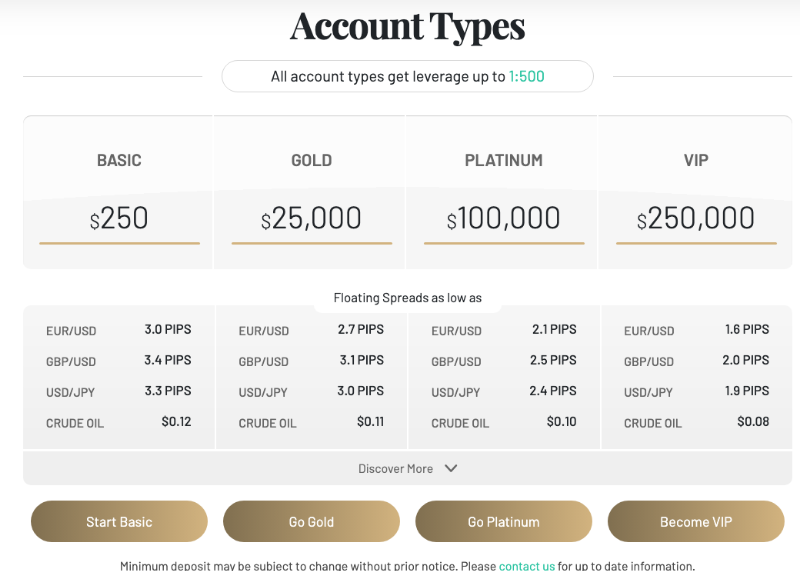

Four types of accounts are available at Investous:

- Basic

- Gold

- Platinum

- VIP

All accounts have minimum deposit requirements, starting at $250 for Basic to $250,000 for the VIP account.

Gold offers are significantly better than Basic, but there’s little difference between Gold, Platinum, and VIP. This tactic drives investors to spend a minimum of $25,000 to get better features and pips.

Well-established brokers rarely have huge minimum deposit requirements, and they provide equally excellent services at all account levels to ensure fair trading that doesn’t cost an arm and a leg.

Investous offers a very attractive leverage of 1:500 on all accounts. This is a common feature of trading scams to lure you in and take advantage of your human nature to seek the highest returns on your investment.

Only offshore brokers like Investous offer such leverages. Reputable brokers under the European Securities and Markets Authority (ESMA) and other regulators in the US, Canada, and Japan aren’t allowed to offer maximum leverage that exceeds 1:30 for forex transactions.

Is it safe to invest with Investous?

A quick look at the Investous website, and you’ll think you’ve landed on a descent brokerage that will match all your criteria. But don’t let the sleek design and user-friendly interface fool you. First impressions are not always right in forex trading.

Investous scam red flags

1. Investous banned in the UK

In June 2020, the UK’s Financial Services Authority (FCA) started banning CFD brokers based in Cyprus, and Investous was on the chopping board. F1 Markets Limited’s passporting rights, which allowed them to operate in the UK, were rescinded.

The firm was asked to:

- Cease all activities with UK customers

- Stop selling CFDs and close all UK positions

- Return money to UK customers and notify them of FCA’s action.

Investous was among the firms that charged customers undisclosed fees and failed to pay money owed to investors.

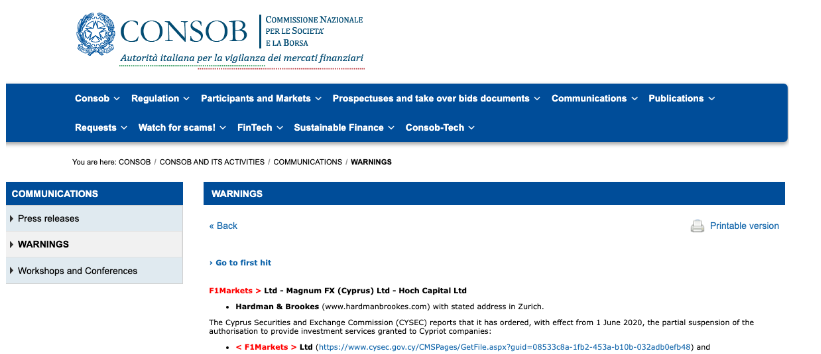

2. CySEC suspension

After the FCA action, the Cyprus Securities and Exchange Commission (CySEC) partially suspended F1 Market Ltd’s regulatory authorizations. Although they were later reinstated, they can only provide investment services to existing non-UK-based clients.

Investous is constantly causing trouble for CySEC, resulting in various suspensions. CySEC strictly prohibited the parent company from providing and promoting investment services to existing or new UK resident clients.

Following CySEC’s and FCA’s actions, Italy’s regulator CONSOB also issued warnings to investors against F1 Markets Ltd.

3. Exorbitant inactivity fees

While inactivity fees are common even among reputable forex brokers, Investous has a highly exploitative inactivity policy. Reputable brokers only charge a small fee after six months of inactivity.

With Investous, you’ll start paying an inactivity fee after one month only. If there’s no trading activity, withdrawals, or deposits on your account from 1 to 2 months, you’ll pay 80 EUR or the equivalent in your currency. The fees will gradually increase until they reach 1,000 EUR after 12 months!

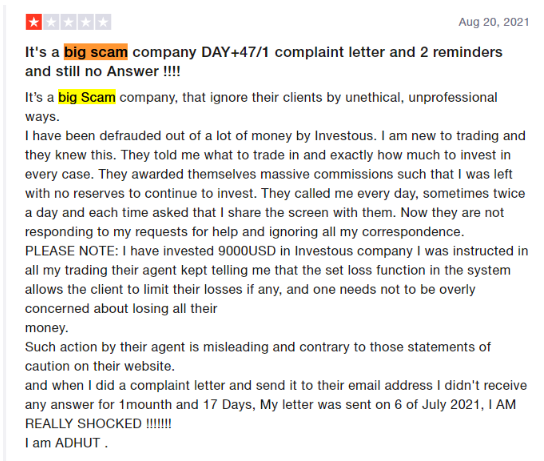

4. Numerous customer complaints

Some quick research on the experience of previous customers will tell you all you need to know about Investous.

While there are a few positive but questionable reviews, the complaints are too many to ignore. Common issues that customers face include:

- Pushy account managers who constantly persuade you to invest more.

- Constant calls urging you to deposit money, robbing you of your peace.

- Accounts disappearing when customers attempt to withdraw and close their accounts.

- Terrible advice to borrow loans or credit to trade.

Investous review verdict: Is Investous a scam CFDs and Forex Broker?

The facts from this Investous review show that Investous is indeed a scam despite its attempts to look and feel legitimate. Its main is to milk you dry through unreasonable fees, shady advice, and high minimum deposits.

Investous only boasts a sleek website and numerous instruments, but it remains very vague about its services. You should avoid it at all costs if you care about your investment and peace of mind.

If Investous or any other online entity is taking you in circles when you attempt to get your money, try our free consultation today to get back your cash!

This broker is a scam if only I had read about them before going into trade with them. they keep telling me to deposit more of my funds.. After I read about them and concluded and decided to reach out to Mrs. Doris after I read so many reviews on how She has helped a lot of victims. Well, I am glad Mrs. Doris was able to help me recover my money.