Tradeo Review: Don’t Be Quick to Trust Tradeo with Your Money

You’ve probably read or heard the statistics: over 90 percent of online forex traders lose their money. It’s probably true, but this is not what makes online forex trading a risky venture since 90 percent of startups also fail.

The actual risk in online trading is the scam forex brokers who lure you into depositing your money and then use deceptive practices to retain most of it.

These brokers do not only steal from you, but also muddy the waters for genuine brokers.

You can stay ahead of the rogue brokers by keeping yourself informed through broker reviews. This Tradeo review helps you assess the features offered by the broker and its business practices to determine if it’s a scam or a genuine broker. It also includes comments from real traders that have used the broker’s services.

If you have already lost money to such scams and cannot retrieve it, reach out for a free consultation session. You will get the proper legal guidance to start the process of recovering your money.

Tradeo Review: What is Tradeo?

Tradeo was established in 2011. It is owned by a parent company known as UR Trade Fix Ltd, whose headquarters are in Cyprus. The broker is registered and licensed under the financial laws of Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC).

You can access and trade major markets and over 200 financial instruments through Tradeo, including forex currency pairs and CFDs.

One of the unique Tradeo features is the social trading setup. Tradeo was not founded as a broker, but as a platform for traders to socialize about trading, share information, and even copy trades.

At that point, traders with any other account could use the social trading platform, irrespective of the broker.

In 2014, the company got licensed as a broker and stopped supporting external brokers henceforth. However, the social trading option is still available for users registered with Tradeo.

Trading Platforms

The broker offers two platforms for registered traders: MetaTrader 4 and WebTrader.

MT4 is currently the most popular and reputable trading platform globally for trading currency pairs, indices, and other CFDs. You can use it on PCs and mobile devices. It’s an insanely reliable platform. Most brokers that offer MT4 also offer MT5, but this is not the case with Tradeo.

Also, like most modern brokers, Tradeo has a trading platform of its own—Tradeo Social WebTrader. This platform is unique because traders can share trading knowledge, including signals and copy trades on the same screen. Other social trading platforms usually require you to switch from the social platform to execute the trades.

In this regard, Tradeo markets itself as a pioneer towards what it believes is the future of forex trading—social trading.

On both platforms, you can open either a demo account or a live account. Demo accounts are great for learners. You can also use them to familiarize yourself with the trading platforms. To open a live account, you will need a minimum deposit of around $250.

The broker’s spreads can be quite high. For example, for EUR/USD currency pair, one of the most popular currency pairs, the minimum spread is 2.7 pips. This is relatively high, considering some brokers offer as low as 1.5 pips for the same currency pair.

Tradeo charges various additional fees depending on your trading activity, including fees for copying trades on the social trader platform. For the trader, the swaps are also high and almost always negative.

It also charges hefty withdrawal and inactivity fees.

Tradeo’s Past and Current Relationship with CySEC

Tradeo’s parent company, UR Trade Fix Limited, is duly registered and regulated by the Cyprus Securities and Exchange Commission (CySEC). But this was not always the case.

As mentioned earlier, between 2012 and 2014, the company was not a registered broker, but only offered social trading services. Users shared information and socialized about trades, but traded through other external brokers.

In 2014, CySEC observed that the company was offering financial services not indicated in its application for a license and fined UR Trade Fix Limited EUR20,000.

The company corrected this act of mischief and registered properly. The current license was issued in 2015.

Beware: Tradeo is not Licensed by the FCA

For UK traders, it is safest to choose brokers that are registered with the Financial Conduct Authority (FCA). They have strong regulations in place to protect you, the trader, and can enforce them if you are scammed. Tradeo is currently not registered with the FCA, although it accepts traders from the United Kingdom.

If you are in the UK, it is best to avoid the broker altogether, mainly because of the complications that were brought up with Brexit.

It is also not registered in the USA and Australia and doesn’t even accept traders from the USA.

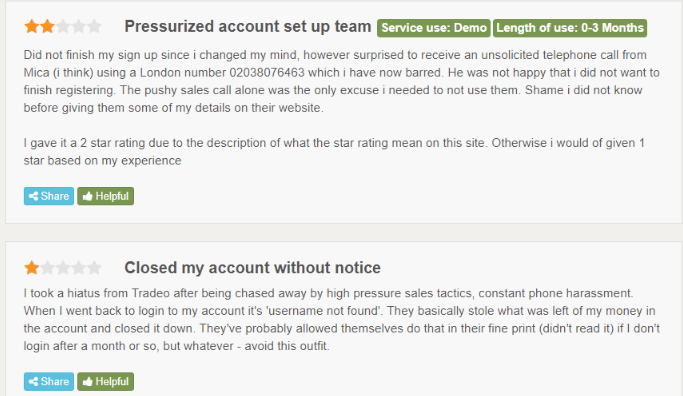

Trader reviews: Possible Harassment

Traders do not shy from sharing details of their experiences in the hands of brokers. And you can tell a lot about a broker from such reviews.

The most common complaint against Tradeo is that it harasses new traders to finish the registration process and deposit more money. This is not acceptable broker behavior. If your broker is doing this to you and has refused to stop, reach out to a Cipher Forensics expert for help.

A trader on Forex Peace Army alleged that once he complained about its constant pressure, Tradeo closed his account and withheld his money.

Tradeo Review Conclusion: Keep off Tradeo

Traders in the United Kingdom, USA, Australia, and other countries where the local authorities do not recognize Tradeo, should not register with Tradeo. They can easily scam you, and it will not be easy to reclaim the money. Always stick with brokers that have been licensed by your financial authority.

Also, go for brokers that will keep your personal information safely. A good broker will not keep harrassing you to deposit money. And they will not close your account without notice.

However, don’t lose hope if Tradeo or any other broker has already scammed you. With the help of experienced recovery experts, you can always get your money back, possibly with damages. Contact us now for a free consultation session. Let’s start the recovery journey together.

Now i am very okay, just a couple of months ago i was in the deepest mess i kinda got myself in, by trusting a Lady i met online and somehow she convinced me she was a trader and could teach me how to trade and got me to invest alot and i emptied my insurance funds into the trading account and lost everything. it almost was one hell of a year, not until i met Kayline my highschool friend who introduced me to her brother who worked with a recovery firm. He took my complaints thesame week and we got through it within 22 hours. I got everything i lost recovered and told my husband about it. it was a wonderful feeling and reliving. i will drop the contact of the agency here as i promised them if they recovered my fund incase someone ends up in thesame mess i was in..

This broker is a scam if only I had read about them before going into trade with them. they keep telling me to deposit more of my funds.. After I read about them and concluded and decided to reach out to Mrs. Doris after I read so many reviews on how She has helped a lot of victims. Well, I am glad Mrs. Doris was able to help me recover my money.